According to previous guidance from tax offices:

+) OL No. 2993/CT-TTHT dated 8/4/2015, issued by the Ho Chi Minh City Tax Office.

+) OL No. 48185/CT-TTHT dated 18/7/2017, issued by the Hanoi Tax Office.

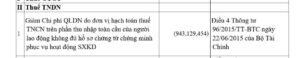

If the labor contract and appointment letter clearly state that the PIT payable by the individual employee – calculated on their entire income (from Vietnam and abroad) -will be paid by the Company, then this PIT amount is treated as a deductible expense when determining CIT.

However, recently, the tax authorities have tended to disallow the PIT expense paid by companies on the global income of foreigners as a deductible expense. The reason provided is the lack of sufficient documents and records to prove that this expense serves the company’s business and production activities.

Reconmendation: Enterprises should be cautious and review their supporting documents to avoid the risk of this expense being disallowed.